106 Tabs of Pure

Analytics Power

Every tool a professional options trader needs, in one platform. GEX analysis, AI-powered signals, volatility modeling, spread detection, pattern recognition, and risk management — all running locally on your machine.

106

Analytics Tabs

37

AI Agents

6

Trading Modes

140+

Pattern Detectors

25+

Spread Types

8

Custom Models

Core Analytics

Institutional-Grade Options Intelligence

Eight flagship analytics modules form the backbone of OPEX Trader. Each processes live market data through proprietary algorithms to surface actionable insights.

GEX Dashboard

Real-time gamma exposure with dealer hedging flows, cascade scoring, and vol regime detection across all expirations.

Options Chain

Full chain visualization with Greeks, OI analysis, institutional flow detection, and strike-level sentiment mapping.

Vol Skew Lab

Advanced skew methodology: 25D/10D skew surface, sqrt-T normalized skew, forward vol extraction, and calendar trade detection.

Vol Curve

Term structure analysis with normalized skew, forward volatility calculations, and z-score based trade signals.

Max Pain

Options expiration pain-point analysis with dealer positioning, pin-risk probability, and settlement price projections.

Spread Scanner

Full lifecycle tracking across 25+ spread types. Dominant spread detection with market maker position analysis.

Dark Pool

Off-exchange flow monitoring with block trade detection, dark pool sentiment, and smart money tracking.

Algo Scanner

Algorithmic order flow detection, sweep identification, and unusual volume alerts with institutional attribution.

Mobile Ready

The full 106-tab OPEX experience on Android. Cloud-powered data via Deribit and Polygon.io. No IBKR account required for mobile.

Forex Suite

7-Tab Currency Intelligence

Professional forex analytics integrated directly into OPEX. Monitor 13 currency pairs with session-aware analysis, carry trade scoring, and a unique Forex→Options Nexus that bridges currency moves to equity options flow.

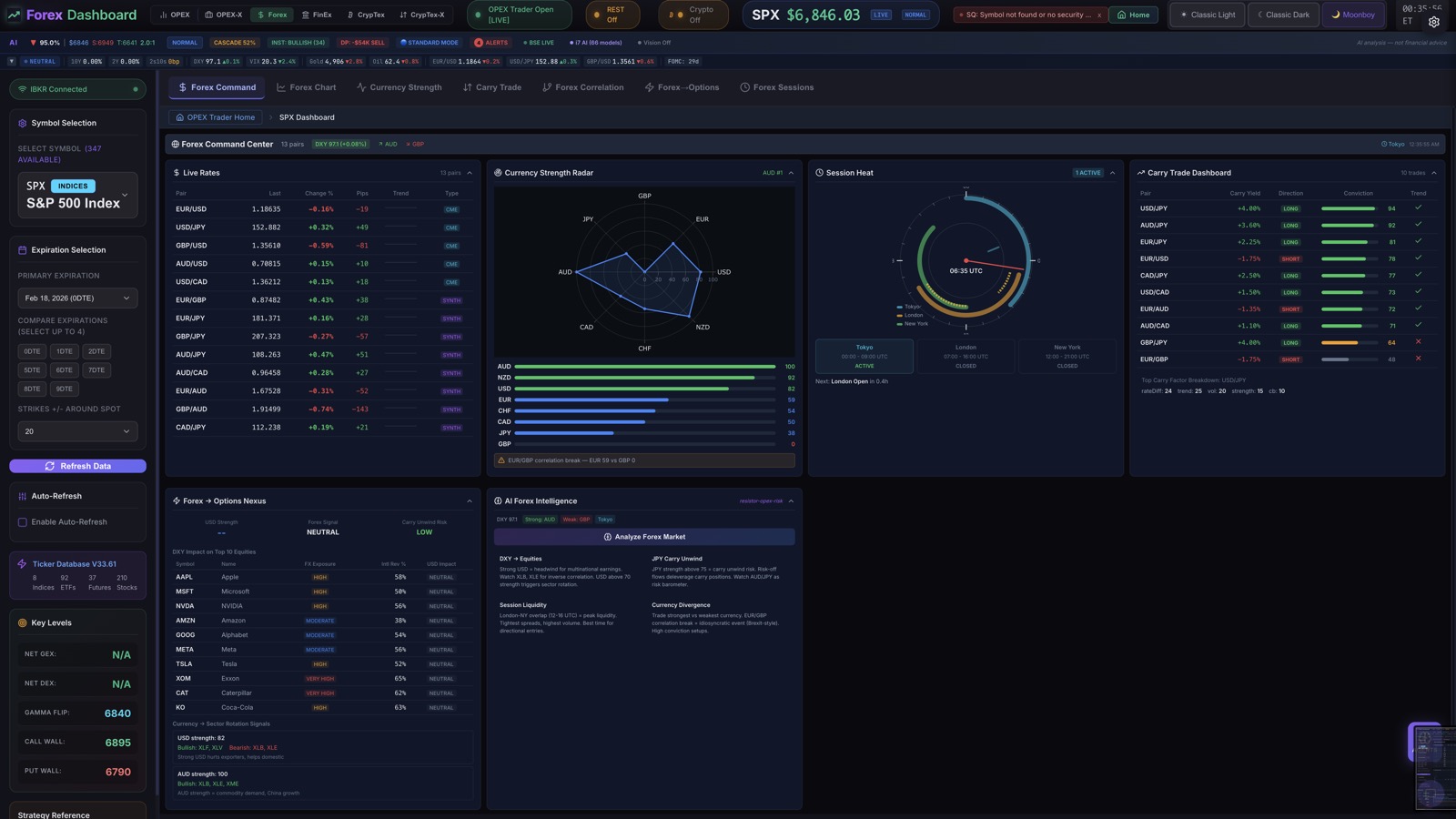

Forex Command Center

6-panel nerve center: live rates for 13 pairs, currency strength radar, session heat map, carry trade rankings, and the Forex→Options Nexus bridge.

Forex Pro Chart

13 major and cross pairs across 6 timeframes with session boxes, pivot points, ADR/AWR bands, and GEX overlay integration.

Currency Strength Index

8×8 currency strength heatmap with real-time divergence alerts, cross-pair rotation signals, and relative momentum scoring.

Carry Trade Monitor

5-factor conviction engine scoring carry opportunities with risk-adjusted rankings, carry vs. momentum scatter, and yield differential tracking.

Forex Correlation

13×13 pair correlation heatmap, DXY decomposition analysis, divergence scanner, and cross-asset correlation tracking.

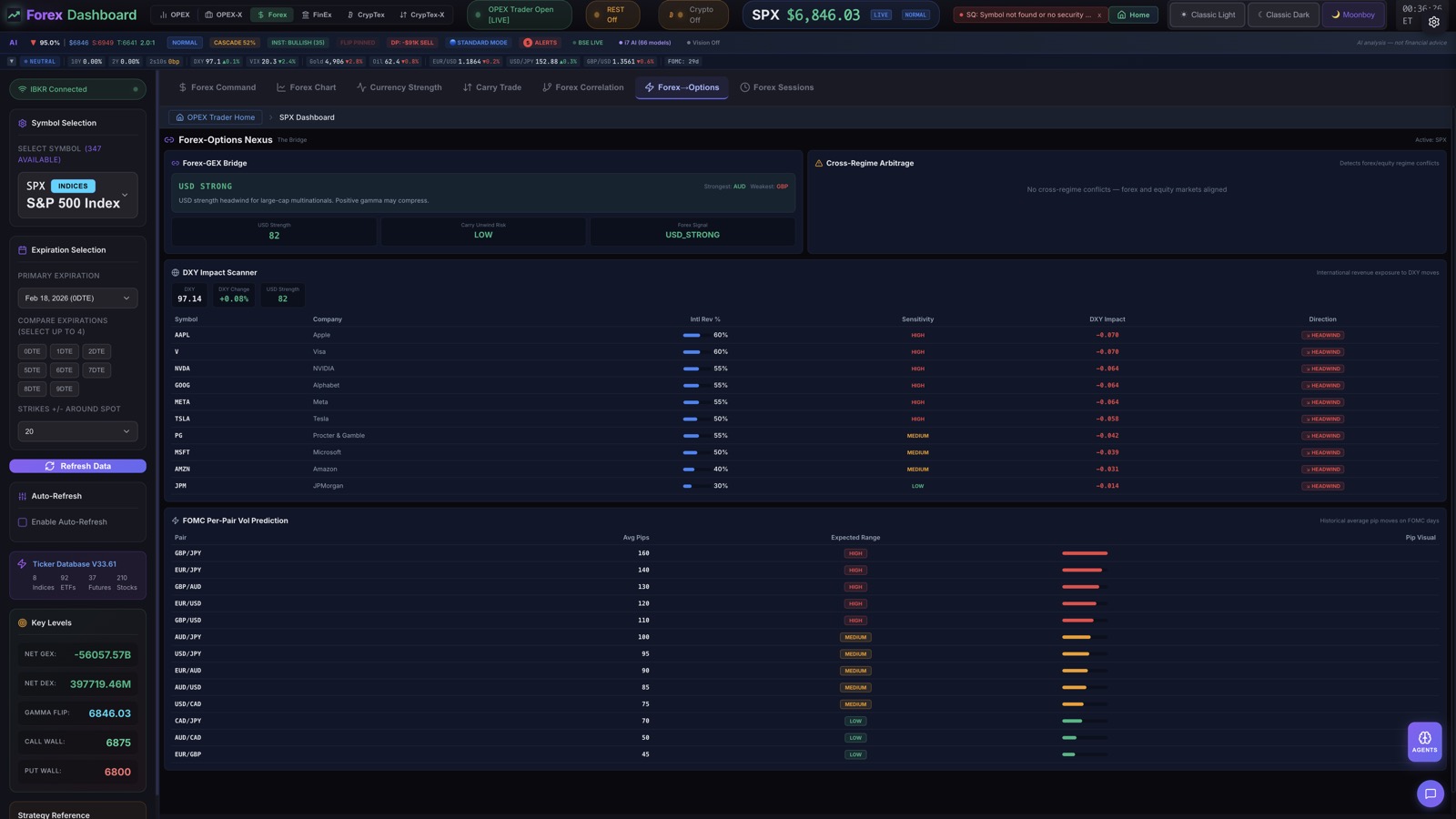

Forex→Options Nexus

DXY impact scanner linking currency moves to equity options. Forex-GEX bridge, FOMC volatility prediction, and cross-regime arbitrage signals.

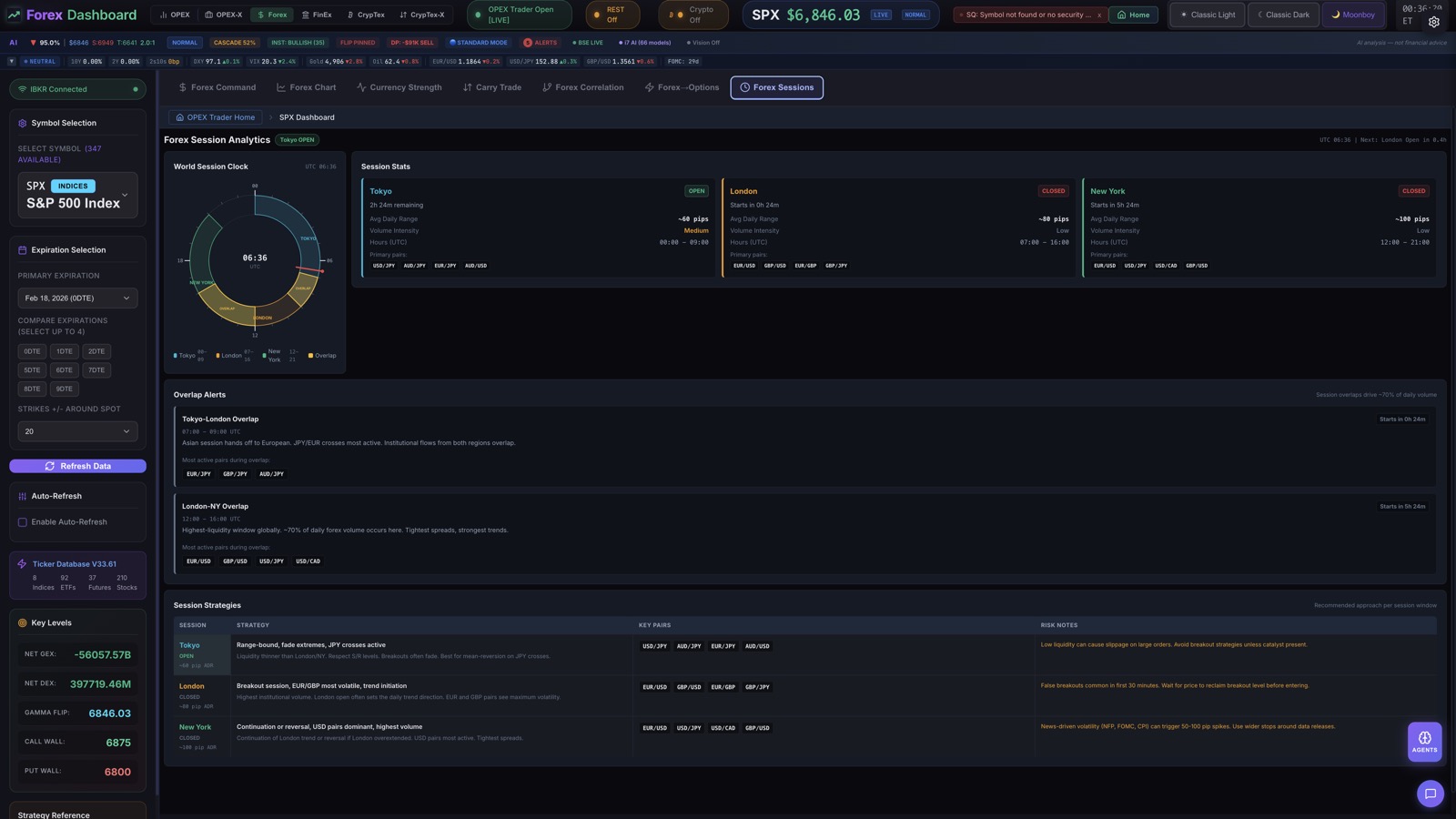

Forex Session Analytics

24-hour world clock with Tokyo, London, and New York session stats. Overlap alerts, session-specific strategies, and historical session performance.

Forex Command Center

Forex Session Analytics

Forex Correlation

Forex→Options Nexus

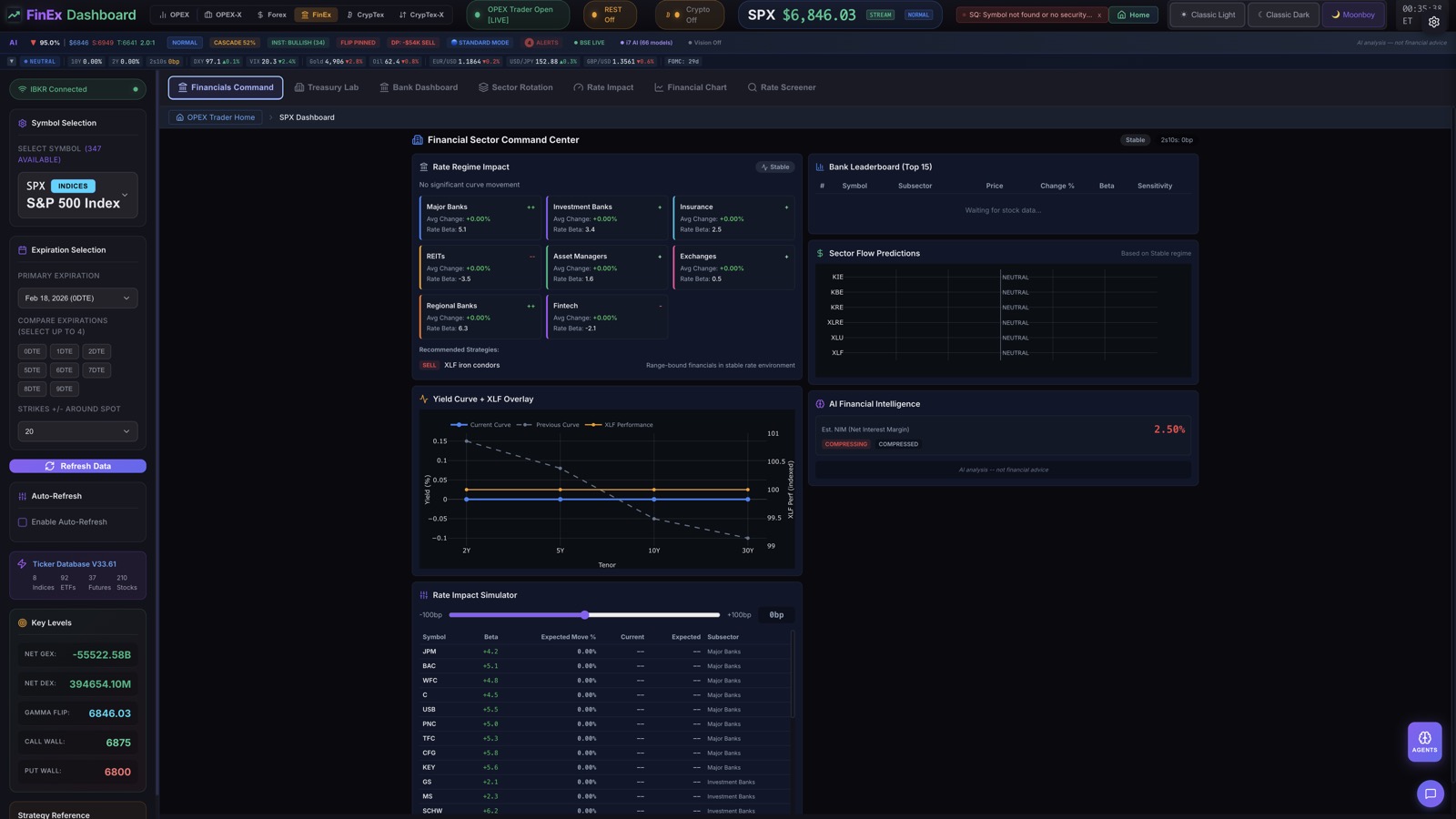

FinEx Intelligence

7-Tab Financial Sector Analytics

Deep financial sector analysis purpose-built for rate-sensitive trading. Treasury yield curve modeling, bank performance tracking, FOMC scenario simulation, and sector rotation scoring across 51 financial stocks.

Financials Command Center

Rate regime impact dashboard with bank leaderboard, yield curve overlay, sector flow predictions, and Fed policy scenario analysis.

Treasury Lab

Interactive yield curve analysis with spread dashboard, curve trade scanner, forward rate extraction, and historical curve comparison.

Bank Dashboard

3×3 grid tracking JPM, GS, MS, BAC, WFC, C, SCHW, USB, PNC with NIM analysis and relative performance charting.

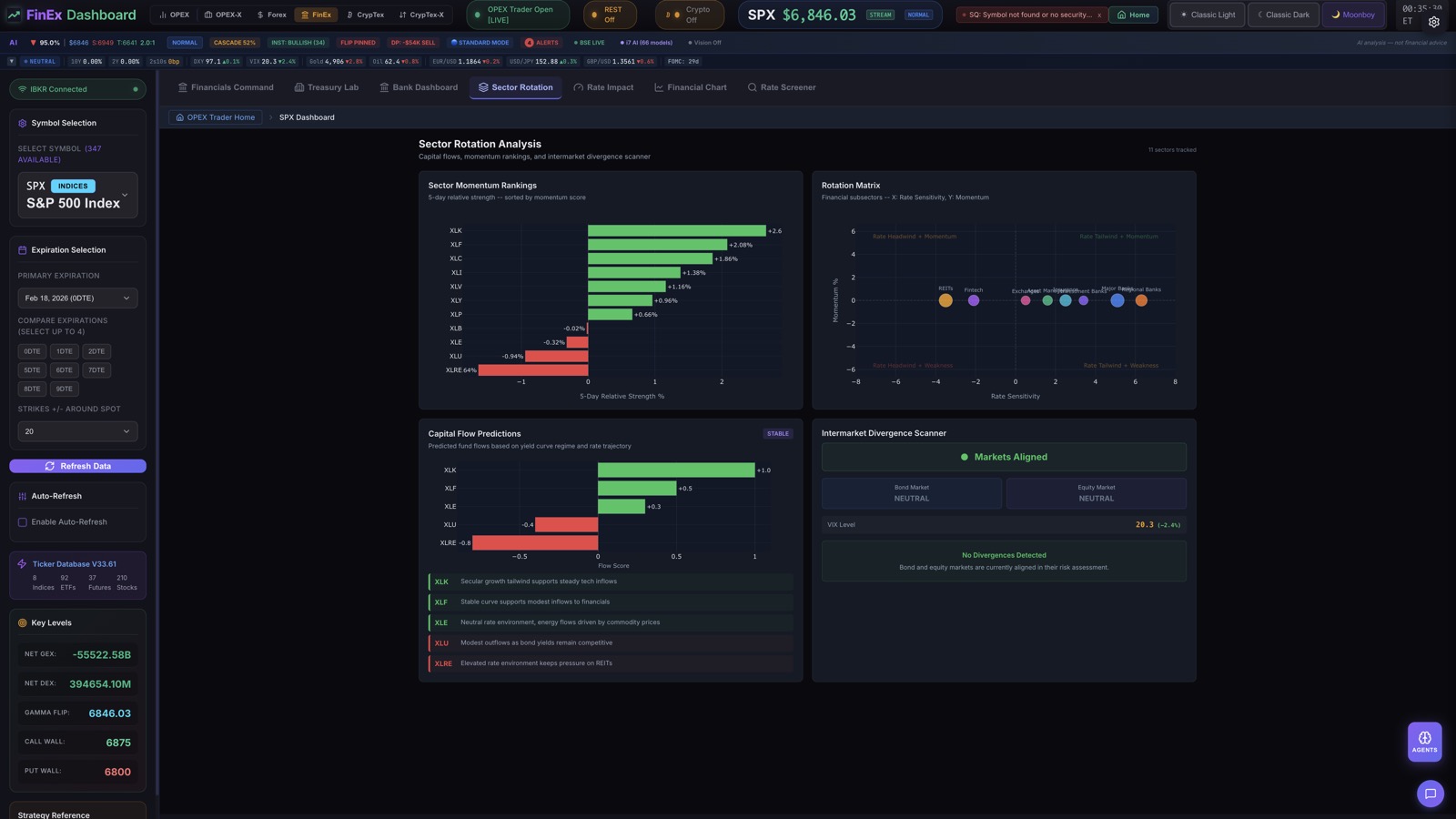

Sector Rotation

11-sector momentum rankings with 4-quadrant rotation matrix, capital flow predictions, and sector-to-rate sensitivity mapping.

Rate Impact Analyzer

Interactive –100bp to +100bp rate simulator. FOMC scenario matrix with per-stock deep-dive impact analysis and hedge recommendations.

Financial Sector Chart

XLF/KRE/KBE charting with 2s10s yield curve overlay, FOMC meeting markers, rate regime badges, and sector ETF comparison.

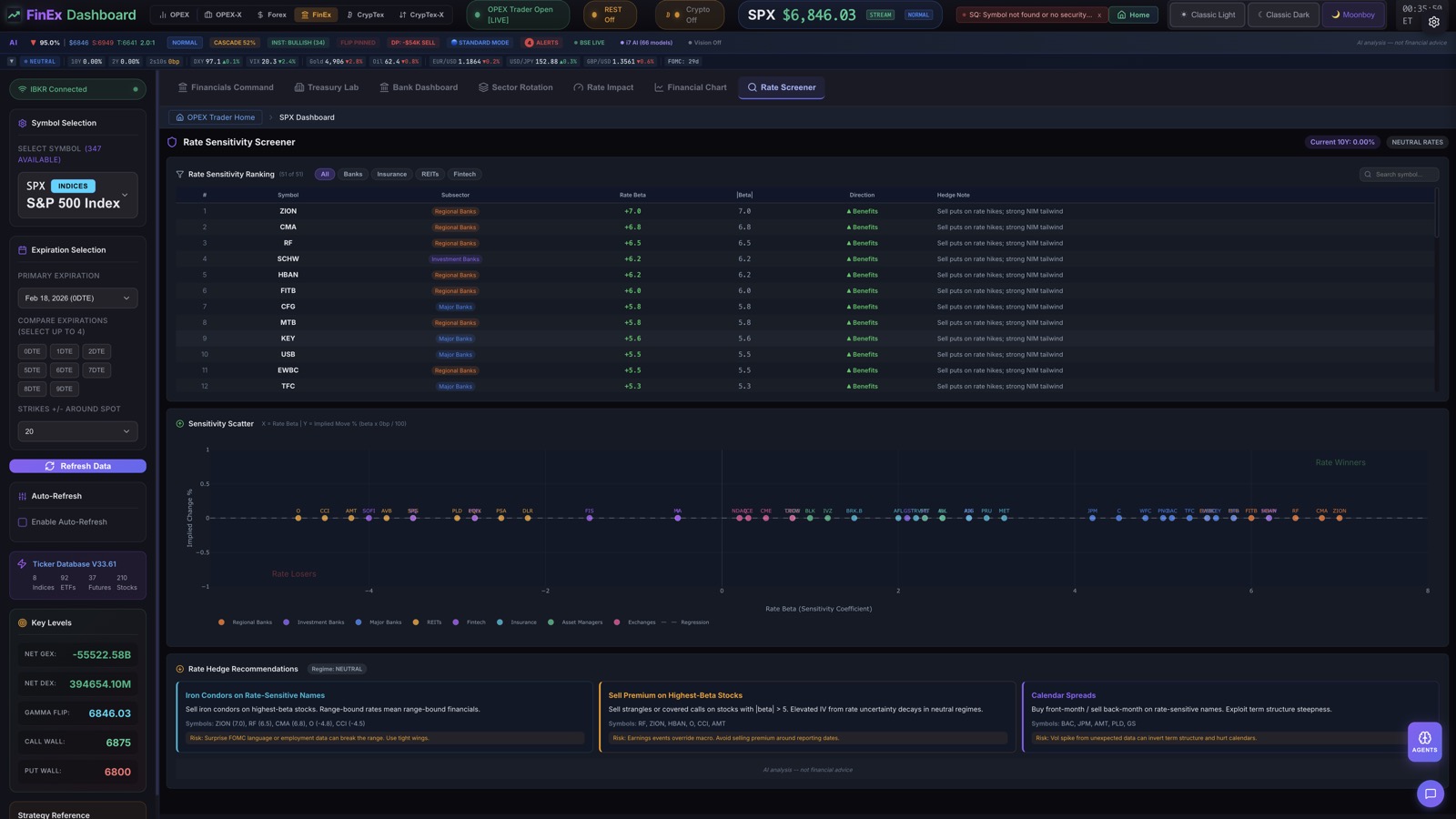

Rate Sensitivity Screener

51-stock ranking table sorted by rate sensitivity. Scatter plot visualization, sensitivity percentiles, and rate hedge recommendations.

Rate Sensitivity Screener

Financials Command Center

Sector Rotation

AI System

God Stack — 7-Tier AI Architecture

A hierarchical multi-agent system purpose-built for options analysis. Each tier runs a custom-trained model optimized for its domain, orchestrated by a 32B parameter commander.

37

Total Agents

8

Custom-Trained Models

7

Architecture Tiers

100%

Local Execution

OPEX-CommanderStrategic orchestration, multi-agent coordination, final verdict synthesis

OPEX-GEX EngineGEX/DEX formulas, dealer hedging, cascade scoring, vol regime, 0DTE gamma

OPEX-Spread Engine25+ spread types, MM pain, OTM signals, institutional detection, earnings methodology

OPEX-FastFast inference, routine analysis, data validation, formatting, summarization

OPEX-VisionChart pattern recognition, screenshot analysis, visual anomaly detection

OPEX-Risk EngineVaR, risk scoring, volatility skew analysis, Kelly criterion, anti-fragility metrics

OPEX-ArchitectArchitecture planning, code generation, implementation strategy, code review

War Room Debate

4-agent adversarial debate system. Bull, Bear, and Neutral agents argue positions before a synthesizer delivers a final verdict with conviction scoring.

Pre-Market Brief

Automated 9:00 AM ET analysis. Three agents run in parallel to scan overnight developments, key levels, and trade setups before market open.

Signal Intelligence

Background Signal Engine continuously monitors 8 signal types across all tracked symbols with real-time alert broadcasting.

Autonomous Scheduling

Auto-validate every 10m, signal accuracy checks every 15m, risk sentinel every 20m. Market open and close triggers with event-driven routing.

Pattern Detection

140+ Pattern Detectors

Comprehensive chart and candlestick pattern recognition scanning every timeframe from 1-minute to monthly. Powered by a full pattern encyclopedia and classical Japanese candlestick methodology.

65 Chart Patterns

Full Pattern Encyclopedia

76 Candlestick Patterns

Grouped by Family

Multi-Timeframe Scanning

Spread Analysis

25+ Spread Types Detected

Full spread lifecycle tracking — from entry setup through active management to close. Every spread type is automatically identified, tracked, and scored with P&L projections.

Lifecycle Tracking

Automatic spread identification with stage-by-stage lifecycle tracking from opening through expiration.

2D + 3D P&L

Interactive P&L diagrams with breakevens, plus 3D Price x DTE x P&L surface visualization in Plotly.

MM Position Analysis

Market maker inventory detection with positioning inference and hedging flow attribution.

Dominant Detection

Automatic dominant spread identification across all active expirations with confidence scoring.

Charting

Professional Charting Suite

GPU-accelerated candlesticks with the OPEX Pro Chart engine, interactive Plotly visualizations for 3D surfaces and heatmaps, and 20+ technical indicators built in.

GPU-Accelerated Charts

OPEX Pro Chart engine with WebGL rendering and sub-millisecond updates. Handles millions of data points without lag.

Plotly Interactive Charts

Bar, scatter, surface, heatmap, and scatter3d visualizations. Hover tooltips, zoom, rotate, and export. Used for GEX, Vol Surface, Risk Heatmap, and more.

20+ Technical Indicators

Full indicator suite from moving averages and Bollinger Bands to Ichimoku Cloud and Volume Profile. Overlay or standalone panel per indicator.

Included Indicators

Risk Management

Multi-Layer Risk Intelligence

Portfolio-level risk analysis with Greeks aggregation, scenario simulation, correlation monitoring, and AI-driven regime classification. Know your exposure before the market moves.

Portfolio Greeks

Aggregate Delta, Gamma, Theta, Vega across all positions. Drill down by symbol, expiration, or strategy. Real-time P&L attribution.

Risk Heatmap

Interactive Price x DTE risk matrix. Run scenario analysis across 5 metrics: P&L, Delta, Gamma, Theta, Vega. Color-coded risk scoring.

Correlation Matrix

15-symbol cross-correlation heatmap with Pearson coefficient calculation across 4 timeframes. Identify diversification gaps.

Liquidation Heatmap

Leverage-based liquidation cluster mapping (2x-50x). Identifies price levels where cascading liquidations are likely to trigger.

VaR Calculations

Value-at-Risk with historical simulation, parametric, and Monte Carlo methods. Kelly criterion position sizing and anti-fragility scoring.

Regime Autopilot

Automatic market regime classification (Trending, Mean-Reverting, Volatile, Calm). Dynamically adjusts risk parameters and strategy selection.

Full Inventory

All 106 Tabs — Searchable

Browse every analytics module organized by category. OPEX Trader ships with 62 equity options tabs, 7 Forex tabs, 7 FinEx tabs, and 30 CrypTex crypto derivatives tabs across 6 trading modes.

Showing 92 of 92 tabs

GEX Dashboard

Real-time gamma exposure and dealer hedging

Options Chain

Full chain with Greeks and flow detection

Max Pain

Expiration pain-point and settlement analysis

Watchlist

Multi-symbol monitoring with conviction ranking

Homepage AI Center

15-symbol scan with sector rotation

Dashboard

Overview with key metrics and market pulse

Settings Panel

IBKR config, broker selection, defaults

Connection Wizard

4-step guided IBKR setup

Agent Panel

32-agent command center with tiered AI architecture

War Room

4-agent adversarial debate with synthesis

Pre-Market Brief

Automated 9AM ET analysis briefing

AI Trade Journal

Trade logging, equity curve, CSV export

AI Trading Assistant

Direct AI assistant with trading knowledge

AI Status Bar

Live agent activity and inference status

Keyboard Commander

Spotlight command palette (Ctrl+P)

Vol Skew Lab

Advanced skew surface analysis

Vol Curve

Term structure with forward vol

Skew Reversal Heatmap

Cross-asset skew reversal command center

Volatility Surface 3D

Interactive 3D IV surface

IV Rank / Percentile

Historical IV context and extremes

Realized vs Implied

RV/IV spread analysis

Spread Scanner

25+ spread types with lifecycle tracking

Spread Visualization 2D

P&L diagrams with breakevens

Spread Visualization 3D

Price x DTE x P&L surface

Long-Term Spreads

LEAPS and long-duration strategies

Earnings Spreads

Event-driven spread methodology

MM Position Scanner

Market maker positioning analysis

Dark Pool

Off-exchange block trade monitoring

Unusual Activity

Anomalous volume and OI detection

Algo Scanner

Algorithmic order flow identification

OTM Scanner

Out-of-the-money signal detection

Institutional Flow

Large-lot and sweep trade tracking

Block Trade Monitor

Real-time block trade alerts

Signal Timeline

Chronological 8-type signal feed

Signal Historian

Historical signal accuracy tracking

Alert Intelligence

Smart alert prioritization and routing

Sniper Mode

Precision entry/exit with R:R and cascade risk

OTM Signal Tracker

OTM cluster monitoring and alerts

Pro Chart

GPU-accelerated candlesticks, 20+ indicators

Multi-Timeframe

1min to Monthly synchronized views

GEX Chart

Gamma exposure overlay on price

0DTE Chart

Zero-day expiration focused analysis

Volume Profile

Price-at-volume distribution

Tick Chart

Tick-level price action

Pattern Scanner

65 chart patterns with win rates

Candle Scanner

76 candlestick pattern families

Harmonic Patterns

Gartley, Bat, Butterfly, Crab detection

Divergence Scanner

RSI, MACD, OBV divergence alerts

Risk Manager

Portfolio-level risk dashboard

Portfolio Risk Heatmap

Price x DTE risk matrix with scenarios

Correlation Matrix

15-symbol cross-correlation heatmap

Liquidation Heatmap

Leverage-based liquidation clusters

Monitor

Real-time position and P&L monitoring

Regime Autopilot

Automatic market regime classification

Sector Rotation

Cross-sector strength analysis

Earnings Calendar

Event-driven opportunity scanner

Macro Dashboard

Macro indicators and regime context

Correlation Tracker

Dynamic correlation monitoring

Trade Planner

Entry/exit strategy with risk parameters

Position Builder

Multi-leg position construction

Order Flow

Real-time order book analysis

Greeks Explorer

Interactive Greeks visualization

Backtest

Historical strategy validation

Forex Command Center

6-panel nerve center: live rates, currency strength radar, session heat, carry trades, Forex→Options Nexus

Forex Pro Chart

13 pairs, 6 timeframes, session boxes, pivot points, ADR/AWR bands, GEX overlays

Currency Strength Index

8x8 strength heatmap, divergence alerts, sector rotation signals

Carry Trade Monitor

5-factor conviction engine, risk-adjusted rankings, carry vs momentum scatter

Forex Correlation

13x13 correlation heatmap, DXY decomposition, divergence scanner

Forex→Options Nexus

DXY impact scanner, Forex-GEX bridge, FOMC vol prediction, cross-regime arbitrage

Forex Session Analytics

24-hour world clock, session stats, overlap alerts, session strategies

Financials Command Center

Rate regime impact, bank leaderboard, yield curve overlay, sector flow predictions

Treasury Lab

Interactive yield curve analysis, spread dashboard, curve trade scanner, forward rates

Bank Dashboard

3x3 bank grid (JPM, GS, MS...), NIM analysis, relative performance chart

Sector Rotation

11-sector momentum rankings, 4-quadrant rotation matrix, capital flow predictions

Rate Impact Analyzer

Interactive -100bp to +100bp simulator, FOMC scenario matrix, per-stock deep dive

Financial Sector Chart

XLF/KRE/KBE charting with 2s10s yield overlay, FOMC markers, rate regime badges

Rate Sensitivity Screener

51-stock ranking table, sensitivity scatter plot, rate hedge recommendations

Crypto GEX Dashboard

BTC/ETH gamma exposure via direct exchange feed

Crypto Vol Curve

Crypto term structure analysis

Crypto Skew Lab

Crypto skew surface and forward vol

Crypto OTM Scanner

Crypto OTM signal detection

Crypto Options Chain

BTC/ETH full chain with Greeks

Crypto Max Pain

Crypto expiration pain analysis

Crypto Monitor

24/7 crypto position monitoring

Crypto Pattern Scanner

Chart patterns on crypto pairs

Crypto Candle Scanner

Candlestick patterns on crypto

Crypto Spread Scanner

Crypto spread strategies

Crypto Multi-TF

Multi-timeframe crypto analysis

Crypto Pro Chart

Full crypto charting suite

Crypto Unusual Activity

Anomalous crypto flow detection

Crypto Dark Pool

Off-exchange crypto monitoring

Crypto Liquidations

Leverage liquidation mapping

Experience all 106 tabs

Download OPEX Trader and start analyzing options with institutional-grade tools. Local execution, no data leaves your machine, no subscription lock-in.